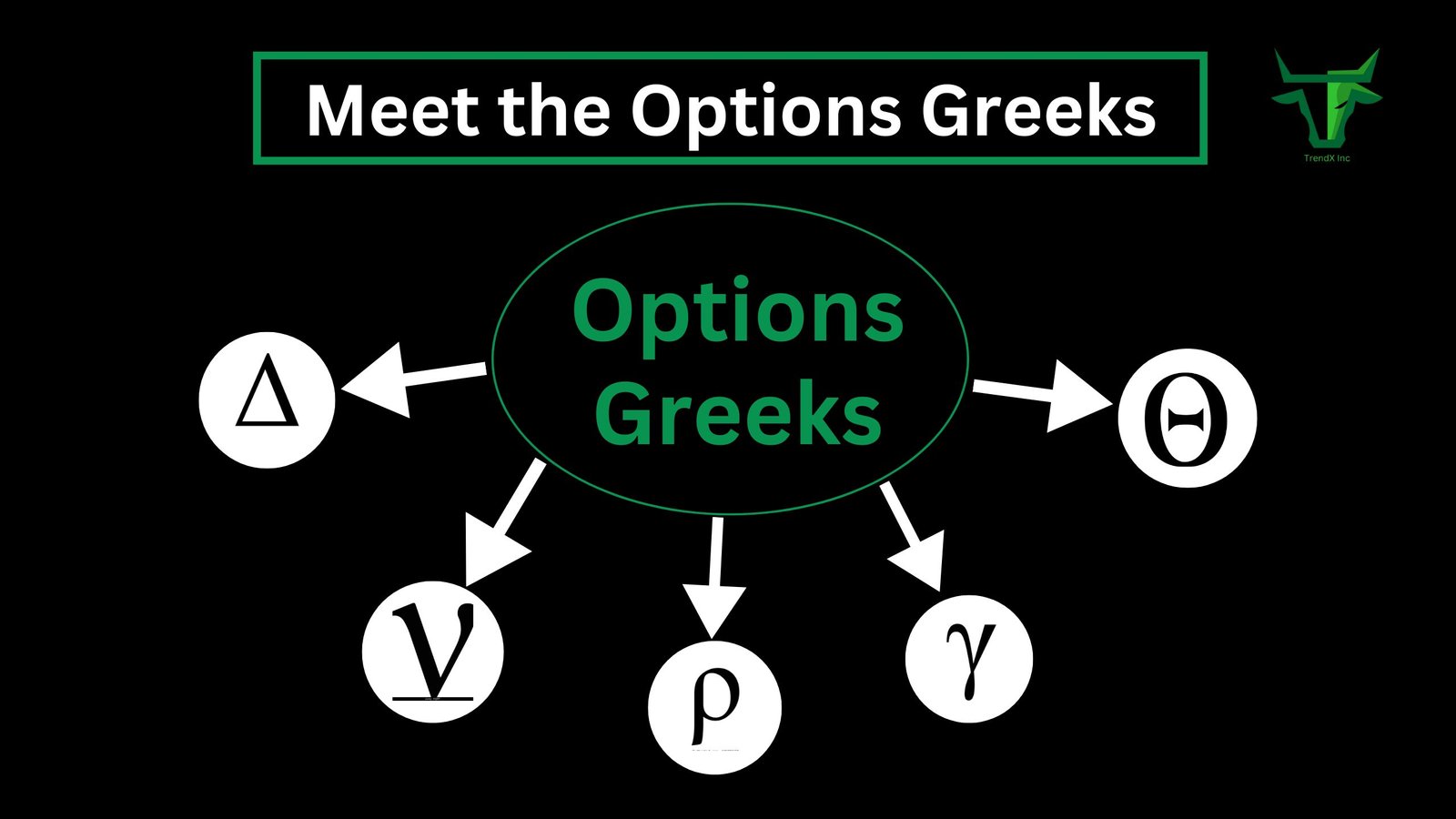

Options trading can seem like a maze of numbers and jargon. But once you understand the “Options Greeks,” the puzzle starts to make sense. These mathematical metrics help traders analyze how options prices change and manage their risks effectively. Let’s break it down in simple terms.

Delta: The Sensitivity Measure

Delta measures how much an option’s price changes with a $1 move in the underlying asset. Here’s what you need to know:

- Range: Delta values range from -1 to 1. Calls have positive Delta; puts have negative Delta.

- Purpose: It shows how sensitive your option is to price changes in the stock.

- Example: A Delta of 0.5 means the option’s price will move $0.50 for every $1 change in the stock’s price.

- Pro Tip: Delta also indicates the probability of the option expiring in the money.

Join free telegram educational group – t.me/trendxinc

Gamma: The Accelerator Options Greeks

Gamma measures how Delta changes when the stock price moves. Think of it as Delta’s rate of change:

- Range: Gamma is highest for at-the-money options and decreases as options go deeper in- or out-of-the-money.

- Purpose: It helps traders understand how their Delta exposure might shift.

- Example: If Gamma is 0.05, Delta will increase by 0.05 for every $1 move in the stock.

- Pro Tip: High Gamma can lead to rapid changes in Delta, increasing both risk and opportunity.

Theta: The Time Decay Factor of Options Greeks

Theta measures how much an option’s price decreases as time passes. Time is a crucial factor in options trading:

- Range: Theta is usually negative because options lose value as expiration approaches.

- Purpose: It quantifies the impact of time decay on your position.

- Example: A Theta of -0.10 means the option’s price will drop by $0.10 daily, all else being equal.

- Pro Tip: Theta decay accelerates as expiration nears, especially for out-of-the-money options.

Vega: The Volatility Gauge

The Options Greeks Vega measures how an option’s price changes with fluctuations in implied volatility (IV):

- Range: Vega is highest for at-the-money options and decreases for deep in- or out-of-the-money options.

- Purpose: It highlights the impact of market uncertainty on option pricing.

- Example: A Vega of 0.15 means the option’s price will increase by $0.15 for every 1% rise in IV.

- Pro Tip: Options tend to become more expensive when volatility increases, benefiting holders.

Rho: The Interest Rate Sensitivity

Rho measures how an option’s price reacts to changes in interest rates. While often overlooked, it plays a role:

- Range: Positive for calls and negative for puts.

- Purpose: It’s more relevant for longer-dated options and periods of significant interest rate changes.

- Example: A Rho of 0.05 means the option’s price will rise by $0.05 for every 1% increase in interest rates.

- Pro Tip: Use Rho to assess interest rate risks in your portfolio.

Also read – Mastering the Art of Day Trading: A Beginner’s Guide to Stocks and Options

Implied Volatility: Like a Greek

While not a Greek, implied volatility (IV) is vital for options traders. It represents the market’s expectation of future price movement:

- Impact: High IV increases option premiums; low IV decreases them.

- Relation to Greeks: Vega is directly tied to IV, affecting how much option prices move with volatility shifts.

- Pro Tip: Monitor IV to identify over- or underpriced options.

Putting the Greeks to Work

Now that you’ve met the Greeks, here’s how to use them effectively:

- Hedging Risks: Use Delta and Gamma to balance your portfolio against market moves.

- Time Management: Monitor Theta to gauge time decay and plan exits.

- Volatility Insights: Leverage Vega to capitalize on changes in market uncertainty.

- Interest Rate Awareness: Keep Rho in mind for long-term positions.

- Scenario Analysis: Combine the Greeks to predict how your position reacts to various market conditions.

Conclusion

The Greeks aren’t just numbers; they’re your toolkit for mastering options trading. By understanding Delta, Gamma, Theta, Vega, and Rho, you can make informed decisions, manage risks, and seize opportunities. Dive deeper, practice regularly, and watch your trading skills grow.

Ready to put the Greeks to work? Start analyzing your options positions today!